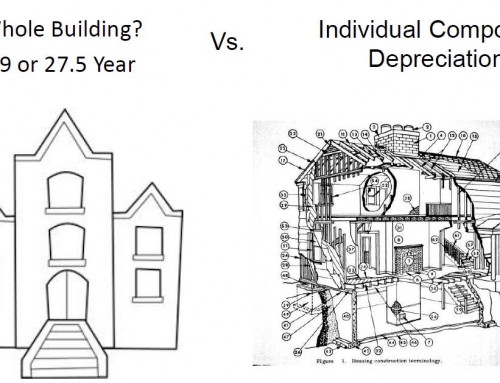

This tax season, we are diligently working with our clients to analyze depreciation schedules with the new IRS Tangible Property Regulations in mind. The effort has paid off with finding over $3,000,000 of additional deductions on 2013 and prior capitalized assets. These additional deductions could be worth anywhere from $1,000,000 to $1,500,000 in saved federal and California income taxes. So, if we contact you regarding your fixed assets and doing a review for the new Tangible Property Regulations give us a hand because it could give you a big payback. If we haven’t talked to you, consider making contact with us regarding this review before you file your 2014 tax returns.

IRS Tangible Property Regulations and What We Can Do for You

By Linkenheimer LLP|2020-09-03T20:05:28+00:00April 6th, 2015|Tangible Property Regulations|0 Comments

About the Author: Linkenheimer LLP

We are a Santa Rosa CPA firm that is focused on our firm culture, local community and partnering with our clients so they can succeed.

Leave A Comment