On June 27, 2025, Governor Newsom signed Senate Bill 132 (the 2025-26 budget trailer bill) into law. The measure delivers several tax changes, but the headline for S-corporations, partnerships, and LLCs is a five-year extension — with new twists — for California’s Pass-Through Entity Elective Tax (PTE).

PTE Quick Refresher: The Pass-Through Entity Tax lets your S-corp, partnership, or LLC pay California tax at the entity level. Why does this matter? It converts state income taxes (limited by the federal SALT cap) into a fully deductible business expense at the federal level. With the federal SALT cap temporarily raised to $40,000 (for most taxpayers) through 2029, then reverting to $10,000 in 2030, the PTE election remains a valuable planning tool — especially for owners with significant state tax liabilities.

What SB 132 Means for Pass-Through Owners

- PTE election extended through 2030: Qualifying entities may continue making the California PTE election for tax years 2026–2030, preserving valuable federal tax benefits for owners regardless of federal SALT cap changes.

- June 15 prepayment no longer “all-or-nothing”: Missing or underpaying the mid-June deposit will not disqualify your election after 2025. Instead, each owner’s PTE credit gets reduced by 12.5% of any shortfall. Translation? Careful cash-flow planning just became your new best friend.

- Tax rate and mechanics unchanged: The elective tax remains 9.3% of qualified net income, paid via the familiar FTB Web Pay or voucher system. The non-refundable credit continues to flow through to owners as before.

Other Key Tax Changes in SB 132

- Single-sales-factor apportionment becomes mandatory for financial institutions starting with the 2025 tax year

- Motion Picture & Television credit cap more than doubles to $750 million annually for fiscal years 2025-26 through 2029-30

- Military retirement pay exclusion up to $20,000 and wildfire/natural disaster settlement exclusions apply for 2025-2030

- Sonoma County note: The bill clarifies authority to exceed the standard 2% local sales tax cap with voter approval

Action Steps for 2025-26

- Model 2026 scenarios for every pass-through entity, factoring in both the higher federal SALT cap and California PTE election benefits

- Budget that June 15, 2026 prepayment if maximizing the credit matters — remember, shortfalls now mean reduced credits, not disqualification

- Recalibrate owners’ estimated taxes considering both the PTE credit and the temporary federal SALT cap increase

- Watch for FTB guidance on revised forms and the mechanics of the new 12.5% reduction rule

- Coordinate multi-state strategies carefully — the federal SALT cap phases down for high earners (MAGI over $500,000), adding complexity

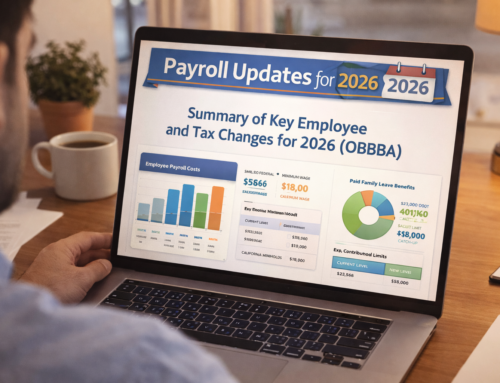

Federal Context: The SALT Cap Roller Coaster

The One Big Beautiful Bill Act temporarily raised the federal SALT cap to $40,000 for 2025-2029 (with 1% annual increases), but it reverts to $10,000 in 2030. Plus, there’s a phaseout starting at $500,000 of modified AGI that can reduce the cap back to $10,000. This makes California’s PTE election extension through 2030 particularly strategic — it provides certainty beyond the federal changes.

We’re Here to Help

Linkenheimer’s team is already weaving SB 132’s provisions into our 2025-26 planning strategies, coordinating with the federal SALT cap changes to maximize your benefits. Ready to explore how these converging rules impact your business? Let’s map out your optimal strategy. Contact your Linkenheimer advisor today.

Bottom line: California just gave you a five-year runway to keep using the PTE workaround, with more flexible payment rules. Combined with the temporary federal SALT cap increase, there’s real opportunity here — but the complexity demands careful planning. We’re on it.

Leave A Comment