It’s that time of year again! Tax season is officially underway, and we’re ready to make this as smooth and stress-free as possible for you.

Your organizers and engagement letters are on their way. If you don’t receive yours within the next week or two, please give us a call—we want to make sure nothing gets lost in the shuffle.

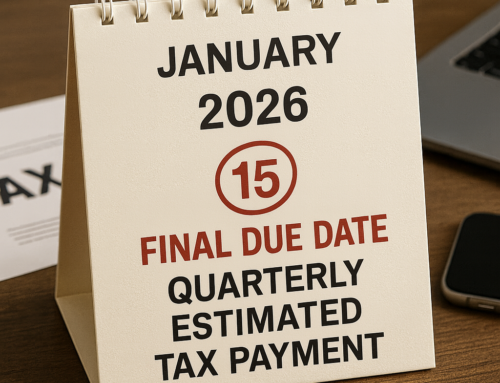

Key Deadlines to Keep in Mind

To ensure we have enough time to prepare your returns (or file extensions if needed), please have your tax documents to us by:

- February 2, 2026 – Business entities

- March 1, 2026 – Individual returns, trusts, C-corps

These cutoffs give us the runway we need to review everything carefully and reach out with any questions before filing deadlines hit.

What You Can Do Now

Start gathering your documents. W-2s, 1099s, mortgage interest statements, charitable contribution receipts, investment summaries—the usual suspects. If you’re not sure what we need, your organizer will have a checklist.

Upload securely through your client portal. This is the fastest, safest way to get documents to us. If you need help accessing your portal, just let us know.

Schedule your appointment. Whether you prefer to meet in person, by phone, or via video call, we’re happy to accommodate. You can schedule by:

- Calling us at 707-546-0272, or

- Using the Book Appointment link in your CPA’s email signature

Questions?

We’re here to help. If anything comes up—new life changes, questions about what’s deductible, or just a quick “does this apply to me?”—don’t hesitate to reach out. That’s what we’re here for.

Here’s to a smooth tax season!

Leave A Comment